Achieving the role of director of admissions requires the ability to think strategically, budget wisely, and have a deep understanding of the institution or organization they will be managing.

Learn what 5 essential skills are needed to excel in this position, and get tips from admission directors like Mena Wahezi on how to move up the ranks and become a successful director of admissions.

Analytical and Critical Thinking.

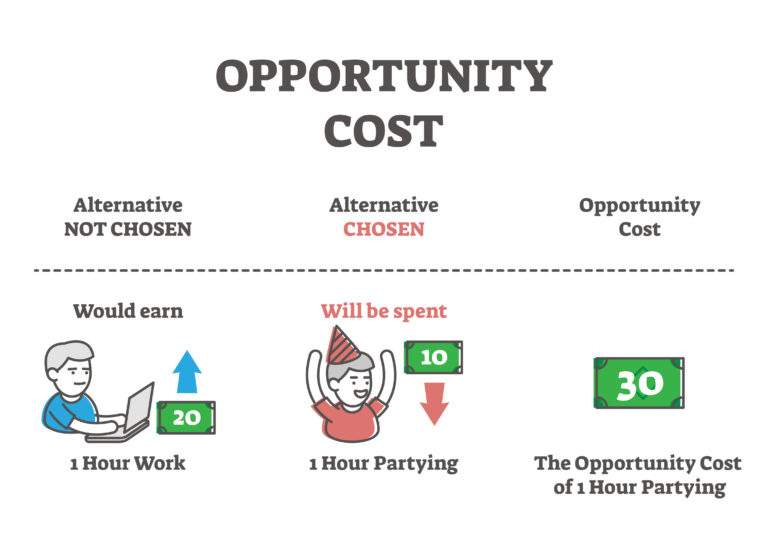

Directors of admissions are expected to be analytical and able to think critically when making decisions. They must be able to understand trends, evaluate complex data and make thoughtful decisions that impact budgeting, staffing, academic policies, and more.

Aspiring directors need to have strong communication skills and the ability to interpret data in order to make informed choices, such as identifying areas for improvement or determining strategies for growth.

Leadership and Communication Abilities.

The director of admissions must have the ability to motivate and lead staff members, manage a team, and provide supervisory guidance when needed. This includes the ability to communicate clearly and ensure compliance with established policies and regulations.

They must be able to effectively evaluate teamwork as well as individual performance in order to find areas of improvement or implementation strategies.

Having excellent conflict resolution skills is essential in this position, as it can often be challenging to come up with solutions that satisfy all parties involved.

Knowledge of College Entrance Exams.

Aspiring directors of admissions must be knowledgeable in the different types of college entrance exams. Whether it is the ACT, SAT, or any other standardized test, a director should have experience and resources to guide students in taking the most appropriate exam for them.

They must understand how to interpret test results and which courses are necessary in order to gain admittance into higher education institutions.

Being up-to-date on new trends can also be beneficial. This includes familiarity with important topics such as advanced placement credit for college enrollment or state funding initiatives for schools.

Understanding of Student Recruitment Strategies.

A director of admissions must understand recruitment strategies in order to effectively bring students into the college. Such strategies include knowing when and where to advertise, target prospective students, and reach out on social media.

Having knowledge of market research and reporting tools can be helpful in identifying trends in higher education market needs as well as evaluating student success and retention rates.

They should also be aware of admission counseling stressors and how troubleshooting different scenarios affect a student’s decisions.

Adaptability and Time Management Skills.

As an aspiring director of admissions, Mena Wahezi recommends being able to think on your feet and prioritize tasks for maximum efficiency is a must. Offering unique strategies tailored to individual student needs is key to success. This includes the ability to analyze issues and craft adjustments for recruitment plans on short notice.

Directors must also collaborate with other departments, abide by data privacy regulations, and manage deadlines in order to fulfill all admissions roles and responsibilities.