Opportunity cost is the difference between what you gain and what you lose by choosing between two or more options. You feel the decision you made will result in better outcomes regardless of what you may lose. Your investment decisions will have both immediate and future gains or losses.

Consider the following example: Sell an asset Now or Hold on to it to sell later. Although an investor may be able to get any immediate gains by selling the asset immediately, they will miss out on any future gains.

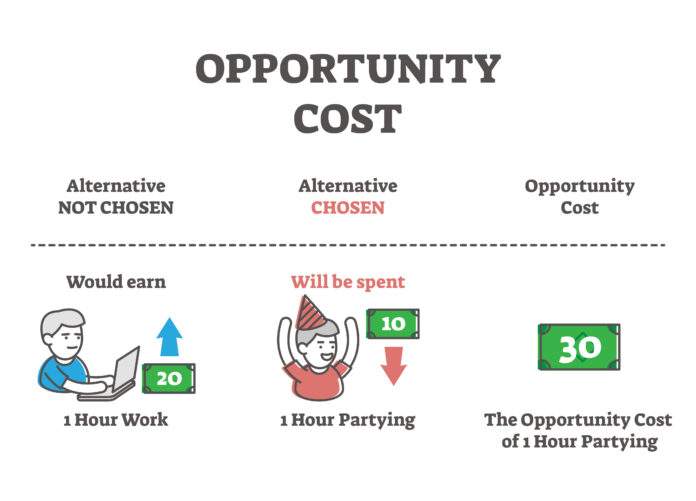

Another example of opportunity costs is choosing between staying home or working. How much are you losing if you choose one option over the other?

David Rewcastle explains that opportunity cost does not only apply to money or investments; it can also be applied to your life.

Read: 5 Tips For Beginners in Cryptocurrency Investing

How to Calculate the Opportunity Cost

Although opportunity cost isn’t an exact measure of it, it can be quantified by estimating the future potential value you didn’t receive and comparing it to the value you chose instead.

The following formula can be used to calculate the opportunity cost:

Opportunity Cost = Return On Most Profitable Investment Choice – Return On Investment Pursued.

According to Darien Financial Analyst David Rewcastle, Opportunity cost is an idea that investors and economists love to study. What would have happened, for example, if Henry Ford hadn’t started mass-producing vehicles? You may not have heard of him, but he might have gone on and done something similar.

Rewcastle stated that opportunity cost is the proverbial “fork in the road”, with dollar signs marking each turn. The key is that there is something to lose and something to gain in every direction. Make an informed decision by estimating your losses.

Read: Create Your Company Financial Plan in 6 Steps

What does Opportunity Cost mean for you?

You may have difficulty understanding the concept. You can’t live in two places at the same time.

Explicit Costs

For investors, explicit expenses are out-of-pocket costs such as the purchase of stock options or spending money on a rental property. Other costs include wages, utilities, and materials.

Implicit Costs

Implicit costs do not represent a financial payment. These are not your direct costs, but the loss of income from your resources.

What is the significance of opportunity cost?

You can make better decisions by understanding the opportunity cost. You can make better decisions and be prepared for the consequences of your choices if you understand all of the possible costs and benefits.